by Saad

- Bookkeeping

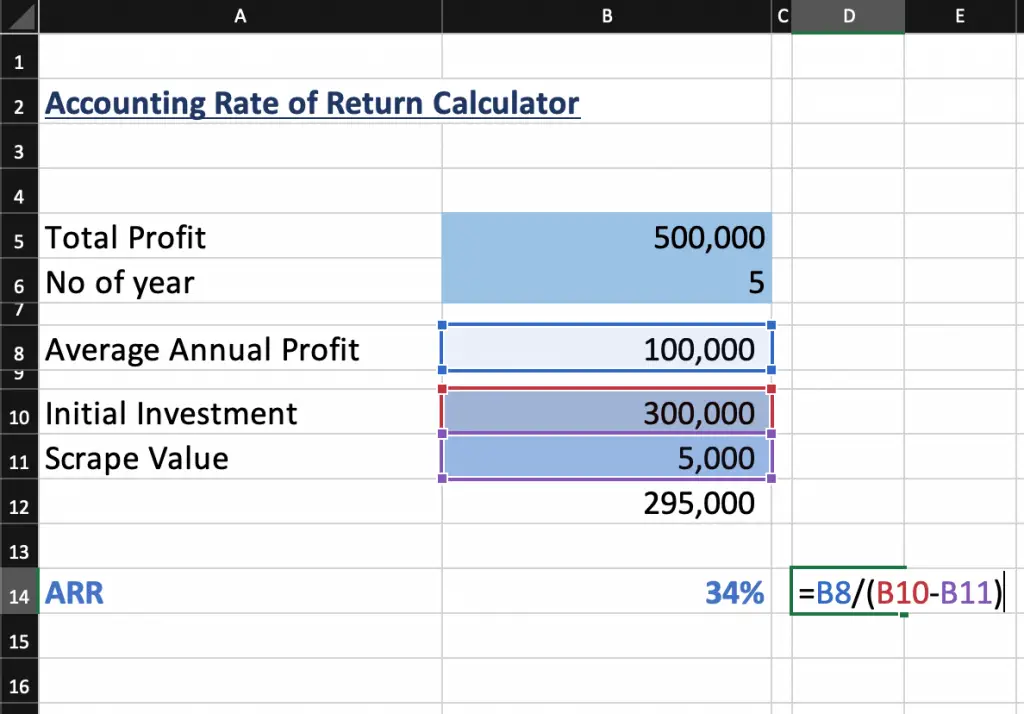

The Record-to-Report R2R solution not only provides enterprises with a sophisticated, AI-powered platform that improves efficiency and accuracy, but it also radically alters how they approach and execute their accounting operations. Accounting Rate of Return is a metric that estimates individual income tax forms the expected rate of return on an asset or investment. Unlike the Internal Rate of Return (IRR) & Net Present Value (NPV), ARR does not consider the concept of time value of money and provides a simple yet meaningful estimate of profitability based on accounting data.

Discover Wealth Management Solutions Near You

- This method is very useful for project evaluation and decision making while the fund is limited.

- The ARR calculator makes your Accounting Rate of Return calculations easier.

- The project looks like it is worth pursuing, assuming that the projected revenues and costs are realistic.

- HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces.

This is a solid tool for evaluating financial performance and it can be applied across multiple industries and businesses that take on projects with varying degrees of risk. The accounting rate of return is one of the most common tools used to determine an investment’s profitability. Accounting rates are used in tons of different locations, from analyzing investments to determining the profitability of different investments. The RRR can vary between investors as they each have a different tolerance for risk. For example, a risk-averse investor requires a higher rate of return to compensate for any risk from the investment.

Get in Touch With a Financial Advisor

The company expects to increase the revenue of $ 3M per year from this equipment, it also increases the operating expense of around $ 500,000 per year (exclude depreciation). Accept the project only if its ARR is equal to or greater than the required accounting rate of return. Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not. Based on the below information, you are required to calculate the accounting rate of return, assuming a 20% tax rate.

Interested in automating the way you get paid? GoCardless can help

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Some limitations include the Accounting Rate of Returns not taking into account dividends or other sources of finance.

Treasury & Risk

Based on this information, you are required to calculate the accounting rate of return. The Accounting Rate of Return (ARR) provides firms with a straight-forward way to evaluate an investment’s profitability over time. A firm understanding of ARR is critical for financial decision-makers as it demonstrates the potential return on investment and is instrumental in strategic planning.

The accounting rate of return is a capital budgeting indicator that may be used to swiftly and easily determine the profitability of a project. Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one. Kings & Queens started a new project where they expect incremental annual revenue of 50,000 for the next ten years, and the estimated incremental cost for earning that revenue is 20,000.

Accounting Rate of Return is calculated by taking the beginning book value and ending book value and dividing it by the beginning book value. The Accounting Rate of Return is also sometimes referred to as the “Internal Rate of Return” (IRR). AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining. If so, it would be great if you could leave a rating below, it helps us to identify which tools and guides need additional support and/or resource, thank you.

Investment evaluation, capital budgeting, and financial analysis are all areas where ARR has a strong foundation. Its adaptability makes it useful for a wide range of applications, including assessing the economic profitability of projects, benchmarking performance, and improving resource allocation. The ARR is the annual percentage return from an investment based on its initial outlay.

The ARR can be used by businesses to make decisions on their capital investments. It can help a business define if it has enough cash, loans or assets to keep the day to day operations going or to improve/add facilities to eventually become more profitable. ARR for projections will give you an idea of how well your project has done or is going to do. Calculating the accounting rate of return conventionally is a tiring task so using a calculator is preferred to manual estimation.

Generally, the higher the average rate of return, the more profitable it is. However, in the general sense, what would constitute a “good” rate of return varies between investors, may differ according to individual circumstances, and may also differ according to investment goals. Like any other financial indicator, ARR has its advantages and disadvantages. Evaluating the pros and cons of ARR enables stakeholders to arrive at informed decisions about its acceptability in some investment circumstances and adjust their approach to analysis accordingly. It’s important to understand these differences for the value one is able to leverage out of ARR into financial analysis and decision-making. The Accounting Rate of Return is the overall return on investment for an asset over a certain time period.