by Saad

- Bookkeeping

- April 7, 2022

- 116

- 0

Consultations are a relatively easy way to build rapport with potential customers, and they can often turn into paying customers. You can easily post the offer on your website and social media accounts, something you can handle on your own without hiring marketing help. Small business owners don’t have a way to determine if you’re credible or not. A great way to show your expertise than speaking simple income statement on a podcast.

They work exclusively bookkeepers, and can create a site designed with your logo, images, and content. After you decide your business name and its structure, it’s time to register with your state. If you’re just starting out and limited on funds, you might consider a sole proprietorship. However, PROCEED WITH CAUTION and consult with an attorney before you begin your business. Preparing a business plan is essential for everyone should do before they start a business.

Make a website and branded email address.

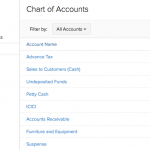

Examples include bookkeeping journal entries, bookkeeping ledger, bookkeeping reconciliation and bookkeeping trial balance. When you work with Ignite Spot Accounting, you’ll get bookkeepers certified in a variety of popular programs, such as QuickBooks and TSheets. If you choose its chief financial officer (CFO) services, your CFO will be a certified public accountant (CPA) at a minimum. Its features include automation of tasks, Gusto payroll processing, balance sheet production, income statements, accuracy checks and transaction databases.

As any good bookkeeper knows, one of your primary jobs is making sure your clients’ financial data is safe and secure. That means communicating with them about who should have access to information and how you prioritize security. Bookkeepers are experts at managing the day-to-day finances of a business. They give small business owners vital information to make better financial investments down the road. Remember, this isn’t a bookkeeping job — it’s your own business. So you set the number of clients, hours, and the amount of time you want to work each week.

Run your business with experts in your corner

Live Expert Assisted doesn’t include cleanup of your books or a dedicated bookkeeper reconciling your accounts and maintaining your books for you. Live Expert Assisted also doesn’t include any financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. Online bookkeeping services typically offer a dedicated contact or team — but these are still virtual bookkeepers, available by email or occasionally by phone. If you don’t want to communicate virtually, these bookkeeper interview questions can help you find a resource near you.

- Grow confidently when you’re ready with our easy-to-add solutions.

- If you only work with small business owners, LinkedIn may be a better fit.

- Customize plans to include other services like accounts receivable processing, inventory reconciliation and payroll support.

- A virtual bookkeeper helps companies stay on financial track, understand their bigger financial picture, and decide where to spend money.

How to start a virtual bookkeeping business step-by-step

You’ll get a dedicated accountant, year-round tax advice, tax prep, bookkeeping and financial reports. Ultimately, it can benefit your business by freeing up your time and ensuring your books are up to date. This puts your business in a solid position come tax time and helps you keep a finger on the pulse of its financial state. Small-business bookkeeping is the process of accurately recording your business’s financial activity. When bookkeeping tasks become too time-consuming to handle on your own, hiring an online bookkeeping service can be a worthwhile investment. These services are typically staffed by people who have access to your accounting software and help make sure none of your financial data slips through the cracks.

Taking the effort to understand what virtual bookkeeping is and how it works will help you start an excellent business. To help you stay up to date on all things virtual bookkeeping and accounting, we’ve compiled a shortlist of resources to help you stay up to date with what’s going on in the industry. You can find information about international and national associations, publications, blogs cb contingent liability and more.

Currently using QuickBooks?

A business email address that uses your company domain (yourbusiness.com), and your name gives your virtual bookkeeping company a how to calculate overhead in your construction business polished look. It’s a cost-effective way to show integrity and reliability. To figure out how you’ll make money as a virtual bookkeeper, you’ll need to write a business plan.